Introduction:

Day trading, a fast-paced world where every decision counts, demands tools that can provide traders with an edge. One such tool that has gained immense popularity among savvy traders is the “Volume Profile.” In this blog post, we’ll explore how the Volume Profile can be a game-changer in your trading strategy, optimizing your decisions for better profitability.

What is Volume Profile?

Volume Profile is a unique charting tool that displays trading activity over a specified time period at certain price levels. Unlike traditional volume indicators that show the total volume traded over a period, the Volume Profile breaks down the volume by price, offering a detailed view of the market’s structure.

Why Volume Profile Matters in Day Trading:

Enhanced Market Understanding: It provides a deeper insight into market dynamics, showing where traders are willing to buy or sell.

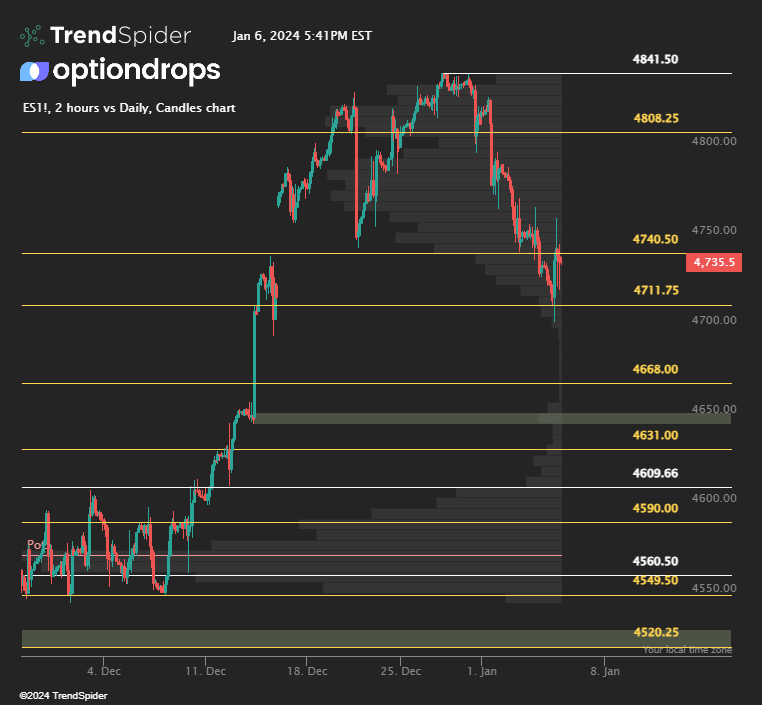

Identifying Key Levels: The Volume Profile highlights areas of high and low trading activity, known as High Volume Nodes (HVN) and Low Volume Nodes (LVN). HVNs can act as support or resistance levels.

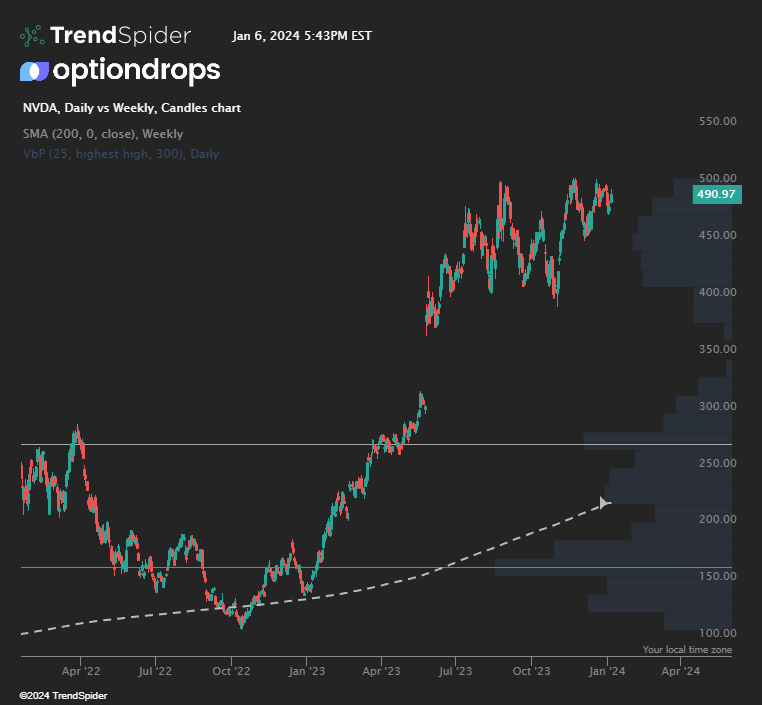

Trade Confirmation: It can be used to confirm the strength of a trend. A rising price accompanied by high volume at higher levels suggests a strong uptrend.

How to Use Volume Profile in Day Trading:

Identifying Market Profile: Understand the market’s balance by looking at the shape of the volume profile. A bell-shaped curve suggests a balanced market, while a P-shaped or b-shaped profile indicates a market driven by excess buying or selling.

Finding Value Areas: Around 70% of trading activity happens in the value area. Identifying this area helps in understanding where the majority of trades are executed.

Price Discovery: The Volume Profile can help in identifying fair prices for assets and potential reversals when prices move away from these levels.

Case Studies and Strategies:

Support and Resistance Strategy: How traders use HVNs as support in uptrends and resistance in downtrends.

Breakout Trading: Utilizing low volume nodes (LVNs) to identify potential breakouts.

Combining with Other Indicators: Enhancing Volume Profile analysis with other technical indicators for a more robust trading strategy.

Conclusion:

The Volume Profile is more than just a trading tool; it’s a window into the market’s soul, revealing the hidden dynamics of supply and demand. For day traders seeking to fine-tune their strategies, incorporating Volume Profile can lead to more informed and potentially more profitable trading decisions. Remember, while it’s a powerful tool, it’s most effective when combined with other technical analysis methods and a solid understanding of market dynamics.

Keep experimenting, and happy trading!