Introduction to Rollovers in Futures Trading

When it comes to futures trading, understanding the concept of rollovers is crucial for traders and investors. A rollover in futures trading refers to the process of closing a position in a contract that is nearing its expiration and opening a new position in a subsequent contract. This is especially relevant in markets where futures do not exhibit significant “gapping up”, indicating a relatively stable transition between contract periods.

Why Rollovers Matter in Futures Trading

Maintaining Market Positions

Rollovers are important as they allow traders to maintain their market positions without the need to liquidate and re-enter trades. This is particularly advantageous in markets where continuity is key to strategy implementation.

Impact on Market Liquidity and Pricing

Rollovers can also significantly affect market liquidity and pricing, especially around the expiration dates of futures contracts. Understanding this dynamic can help traders make more informed decisions.

The Mechanics of Rollovers

Timing and Execution

The timing of a rollover is critical. It usually occurs a few days before the expiration of the current contract. The exact timing can depend on market conditions and the specific commodity or financial instrument.

Rollover Costs and Considerations

It’s important to consider the costs associated with rollovers, including potential price differentials between contracts and transaction fees.

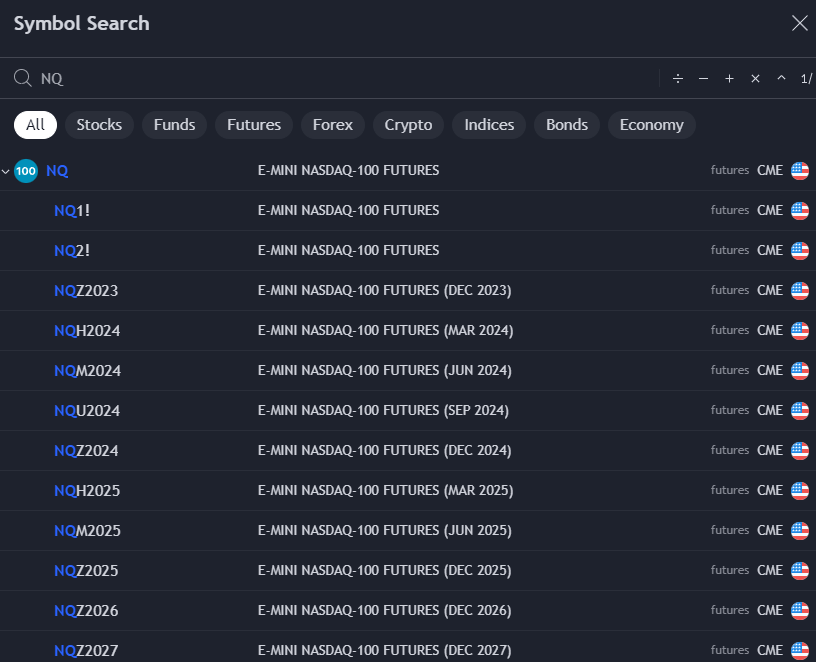

Understanding Futures Contract Codes: “NQZ23, NQH24” Explained

Each futures contract is identified by a unique code, such as “NQZ23” or “NQH24”. These codes are not arbitrary; they carry specific information about the contract. For instance, in “NQZ23”, “NQ” represents the Nasdaq 100 index, “Z” indicates the contract month (December in this case), and “23” signifies the year (2023).

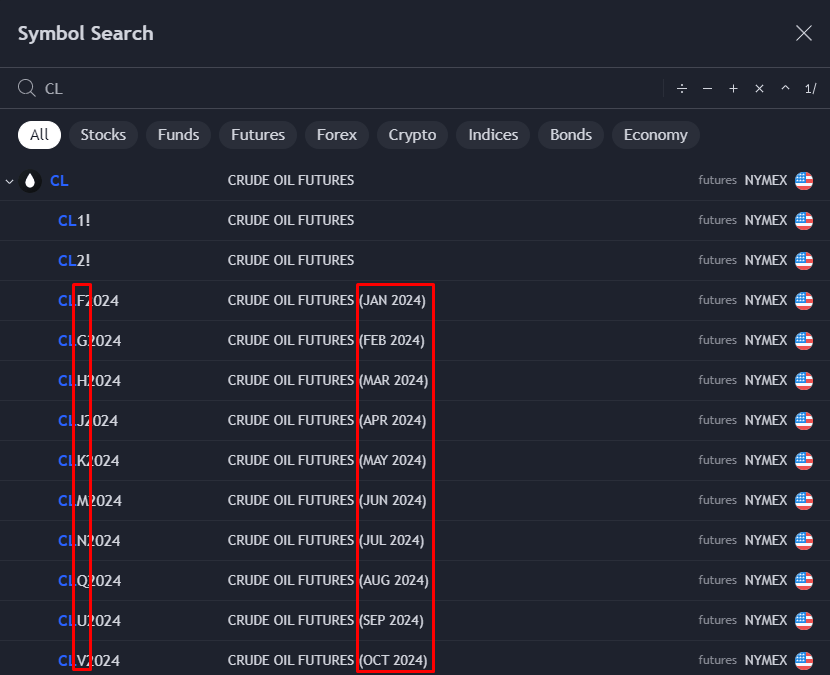

Indicating the Delivery Month

Futures contracts, actively traded on exchanges, include a critical detail known as the delivery date. This date marks the deadline for the fulfillment of the futures contract related to a specific commodity. Exchanges use a distinct coding system, represented by letters in the contract’s ticker symbol, to denote this delivery date. Interestingly, while some letters might be omitted, the system follows an alphabetical sequence. A prime example is the letter “Z,” which corresponds to December, indicating that the delivery of the contract is due in that month. This coding system is an integral part of understanding futures contracts and their timelines.

January: F

February: G

March: H

April: J

May: K

June: M

July: N

August: Q

September: U

October: V

November: X

December: Z

Strategies for Effective Rollovers

Analyzing Market Trends

Before executing a rollover, analyze the market trends. Look for signs of stability or volatility that might affect the new contract.

Considering Contract Differences

Evaluate the differences between the expiring contract and the new one, such as price and liquidity.

Conclusion: The Strategic Importance of Rollovers

Rollovers are a key aspect of futures trading, helping traders to maintain positions and manage risks effectively. Understanding the nuances of rollovers, including the decoding of futures contract codes, is essential for trading success.