Introduction to IV Crush

Options trading is a complex world with various terminologies and strategies. One term that often comes up, especially around earnings season, is “IV Crush.” But what does it mean, and why is it so important for options traders to understand? Let’s dive in.

What is IV (Implied Volatility)?

Before we delve into IV Crush, it’s essential to understand IV or Implied Volatility.

Definition:

- Implied Volatility (IV): It represents the market’s expectation of how much a stock’s price will move in the future. It’s a crucial component in options pricing.

Importance:

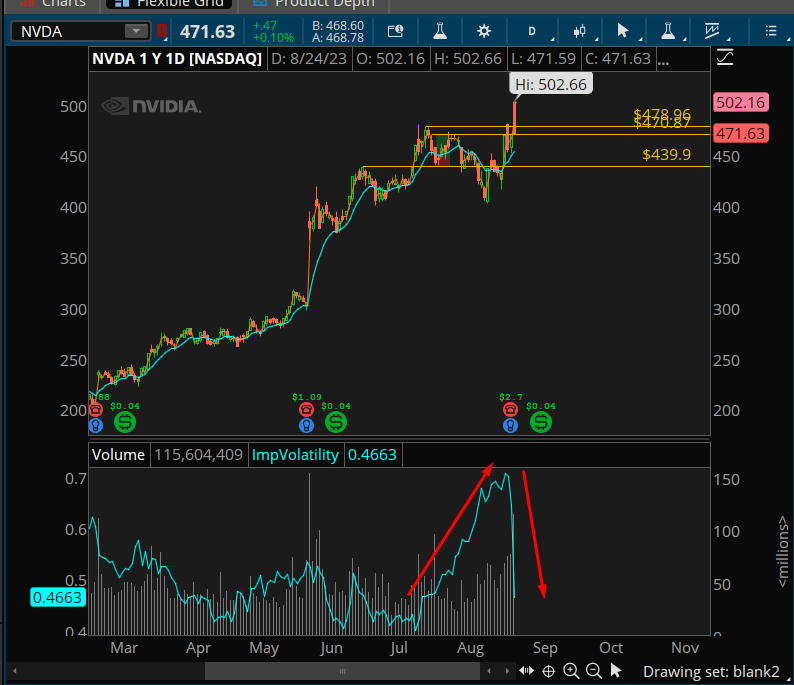

- Predicting Price Movements: A higher IV indicates that the market expects significant price movement, while a lower IV suggests the opposite.

- Options Pricing: IV plays a significant role in determining an option’s premium.

IV Crush: Breaking it Down

Definition:

- IV Crush: This refers to the sharp decline in implied volatility following a significant event, such as an earnings announcement.

Why does IV Crush happen?

- Anticipation and Uncertainty: Before a significant event, there’s a lot of uncertainty about how the stock will perform. This uncertainty drives up the IV.

- Post-Event Clarity: Once the event occurs and the results are out, the uncertainty diminishes, leading to a drop in IV. This sudden drop is what’s referred to as the “crush.”

The Impact of IV Crush on Options

For Option Sellers:

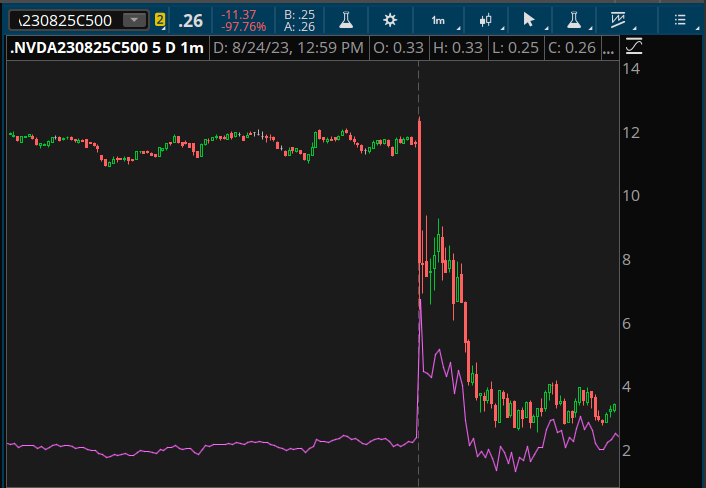

- Beneficial: If you’ve sold an option, IV Crush can be your best friend. As IV drops, the option’s premium decreases, allowing sellers to buy back the option at a lower price or let it expire worthless.

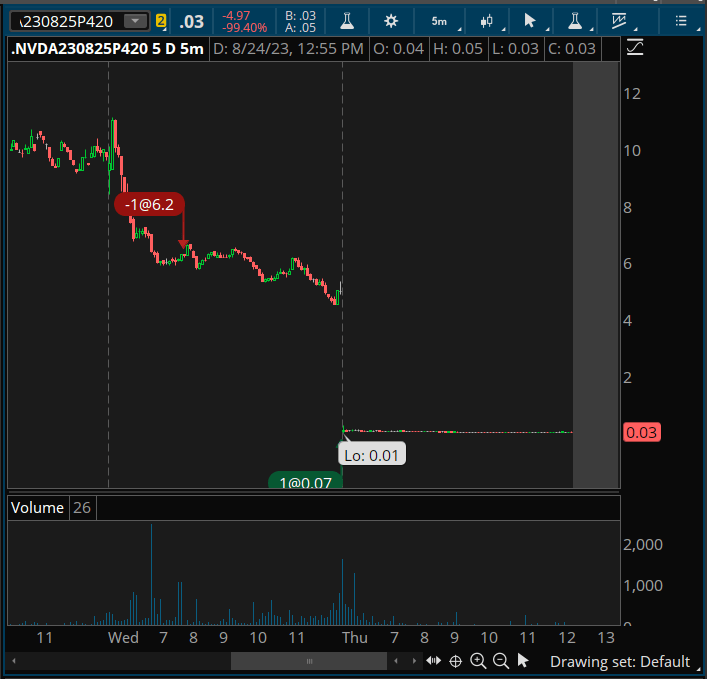

For Option Buyers:

- Detrimental: If you’ve bought an option, especially a short-term one, IV Crush can erode its value quickly. Even if the stock moves in your favor, the drop in IV can offset any gains.

How to Navigate IV Crush

Strategies for Option Sellers:

- Sell Before the Event: Consider selling options before a significant event when IV is high, and then close the position after the event when IV drops.

Strategies for Option Buyers:

- Be Cautious: If you’re buying options before a significant event, be aware of the potential for IV Crush. Consider longer-term options or strategies that benefit from a rise in the underlying stock price.

Conclusion: Emphasizing the Importance of IV Crush

Understanding IV Crush is crucial for anyone involved in options trading. It can significantly impact the value of an option, regardless of the movement in the underlying stock. By being aware of IV Crush and strategizing accordingly, traders can better navigate the volatile world of options and make more informed decisions.

If you learned anything from this article, be sure to check out our weekly newsletter covering futures and stocks we are liking!

If you want to gain more knowledge on implied volatility, market chameleon is a great tool for monitoring everything volatility.