How to Maximize Your Gains: A Guide to Using the 9EMA

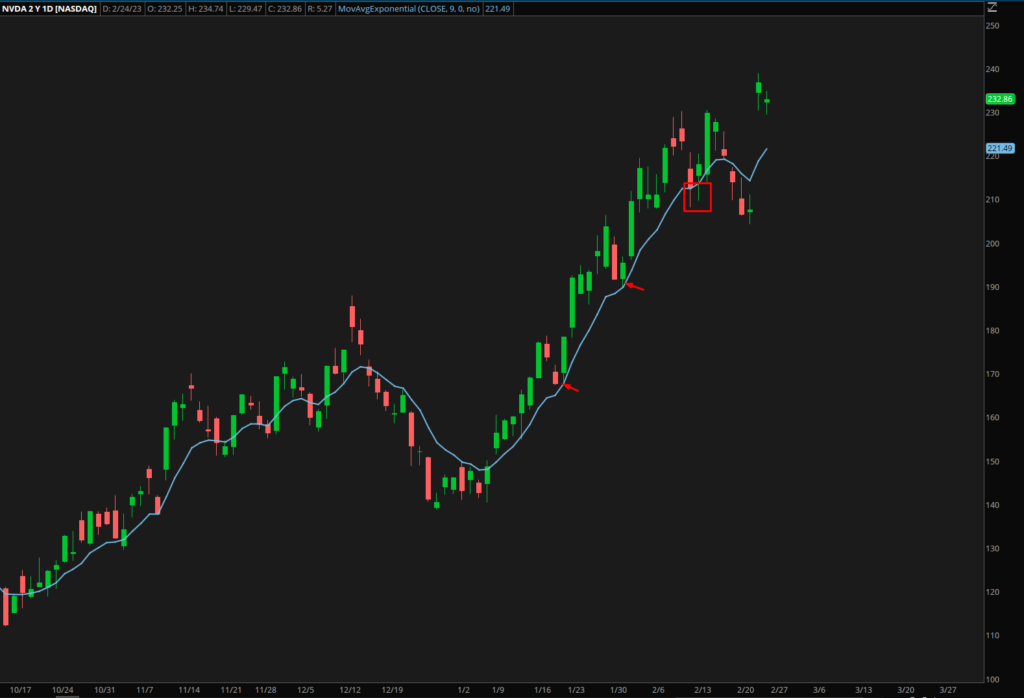

Using the 9EMA or nine period exponential moving average is a popular technique in trading to help maximize gains and hold winners for longer periods. It is an easy-to-use indicator that provides a guide to traders on when to enter or exit a trade.

What is the “EMA?”

The EMA or exponential moving average, is a moving average that gives more weight to recent price action during days when the market is trending or has a clear direction. This feature makes it an excellent indicator to use when traders want to ride a trend and maximize their gains.

The Power of the 9 Period Exponential Moving Average

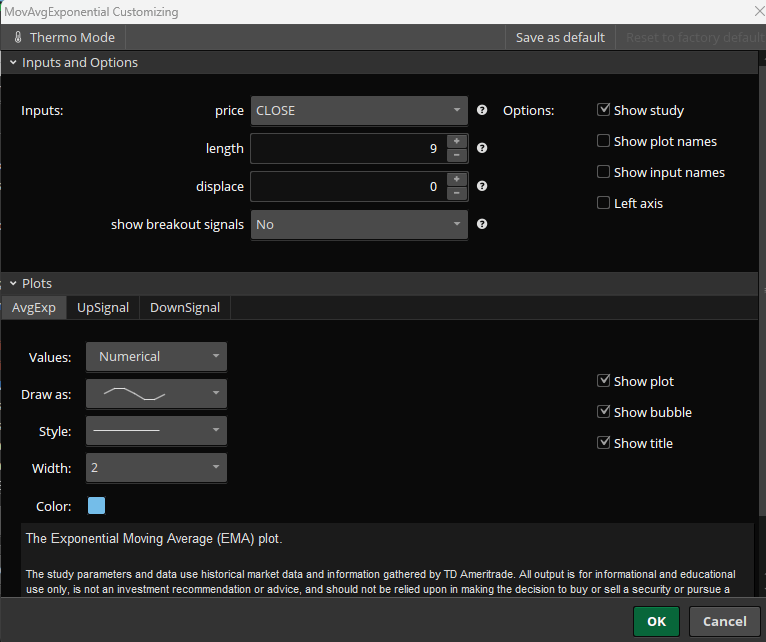

To use the 9EMA, traders can add it to their chart on their preferred trading platform, such as Thinkorswim, and modify it to their preferred color. The 9EMA appears as a line on the chart, and traders can use it as a guide for their trades.

Avoid Common Trading Mistakes with the 9EMA

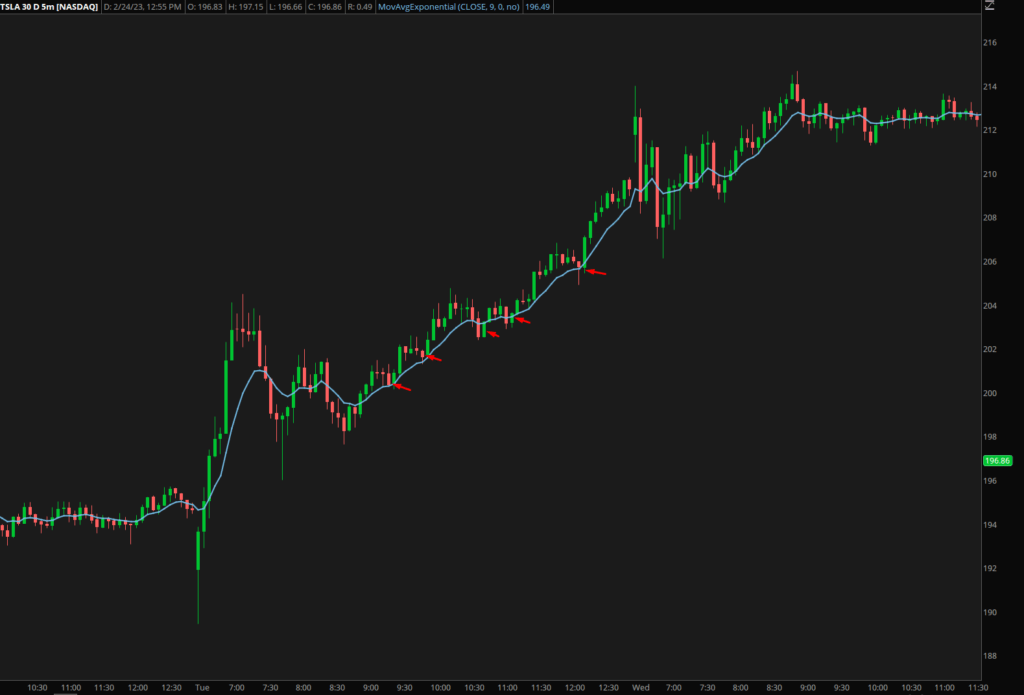

The 9EMA can be applied to any time frame, but the 5-minute time frame is a popular choice for traders. This time frame is suitable for day traders and helps guide their trades to achieve the best results.

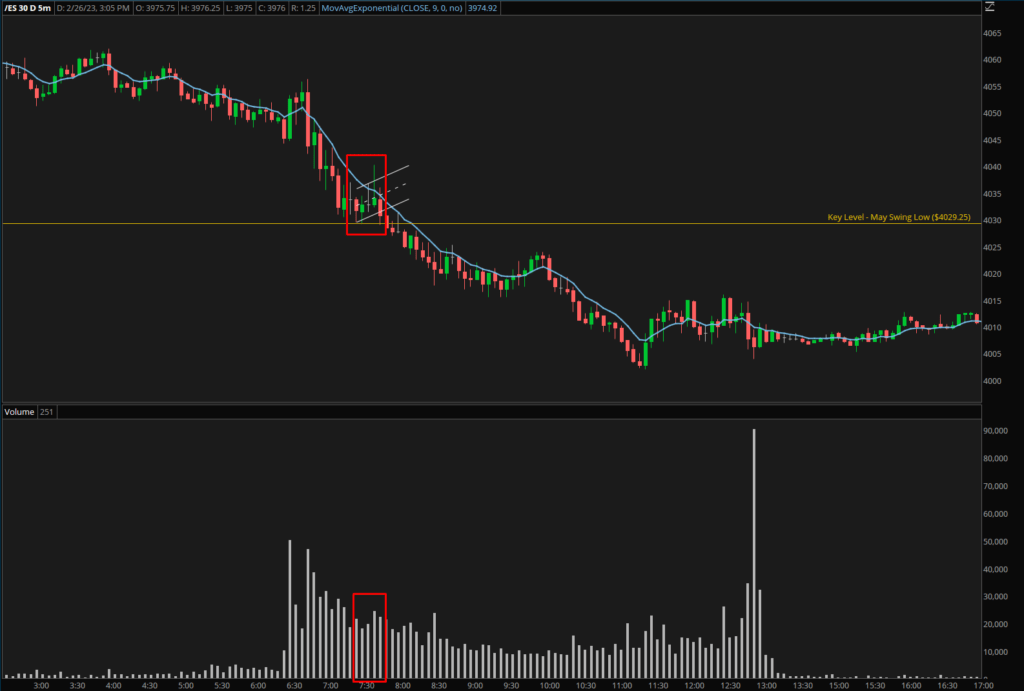

Using the 9EMA can also help traders avoid common trading mistakes, such as selling too early or holding onto a losing position for too long. By following the 9EMA, traders can set clear entry and exit points and minimize drawdowns.

When using the 9EMA, traders should also pay attention to the volume of the market. While the 9EMA is an excellent guide, volume can also provide important information on market sentiment and help traders make informed decisions.

In conclusion, using the 9EMA is a straightforward and effective way to maximize gains and hold winners for longer periods. Traders can add this simple indicator to their chart and use it as a guide for their trades, especially when riding a trend. However, traders should always remember to combine the 9EMA with other technical and fundamental analysis to make informed trading decisions.

If you learned anything from this post, please share it to others and help spread the knowledge. If you want to gain further insights into the market, consider joining our weekly newsletter!