Navigating the world of trading can sometimes feel like learning a new language. With various acronyms thrown around, it’s essential to grasp what each term means to make informed decisions. Below is a compilation of commonly used trading acronyms that every trader should know, including some not listed in the image provided:

Fundamental Trading Acronyms:

- TA: Technical Analysis

- FA: Fundamental Analysis

- E/R: Earnings Report

- YTD: Year-to-Date

- ATH: All Time High

Market Movement Acronyms:

- HOD: High of Day

- LOD: Low of Day

- HH: Higher High

- HL: Higher Low

- LH: Lower High

- LL: Lower Low

Time-Based Acronyms:

- O/N: Over Night

- 52s: New 52 week high

- TF: Time Frame

- MS: Market Structure

- HTF: Higher Time Frame

- LTF: Lower Time Frame

Trade Execution Acronyms:

- BRB: Break-Retest-Bounce/Breakdown

- B/O: Break Out

- BOS: Break of Structure

- Pre: Pre-Market Trades

- AH: After Hours Trades

- R/R: Risk/Reward

- S/R: Support and Resistance

- TP: Take Profit

- SL: Stop Loss

Market Sentiment Acronyms:

- BE: Break Even

- DD: Drawdown

- Be: Bearish

- Bu: Bullish

- HNS: Head and Shoulders

Additional Acronyms to Know:

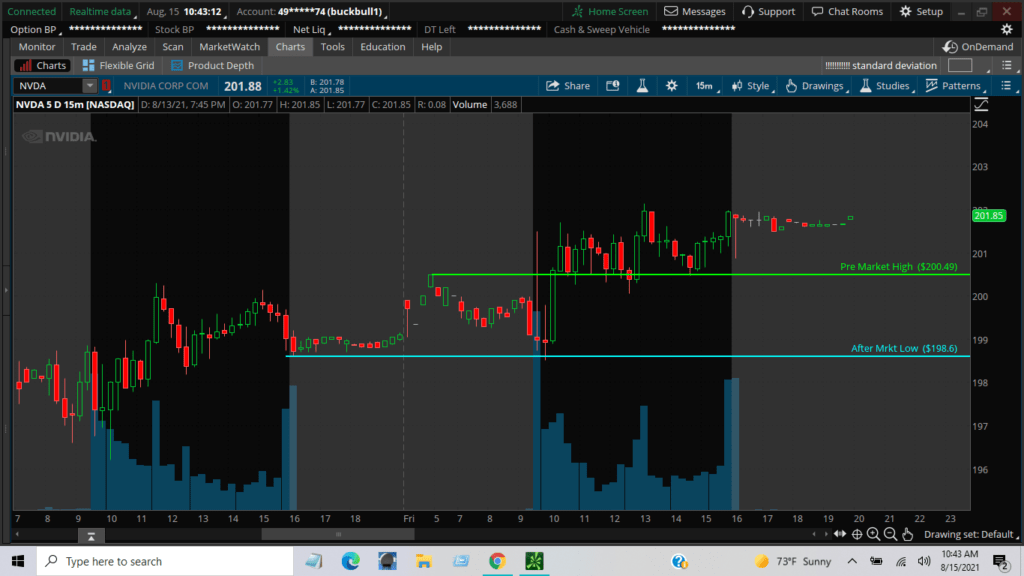

- PML: Pre-Market Low – This refers to the lowest price level of a stock before the market opens.

- PMH: Pre-Market High – Conversely, this is the highest price level of a stock before the market opens.

- PDL: Prior Day Low – The lowest price of the previous trading day.

- PDH: Prior Day High – The highest price of the previous trading day.

Understanding these acronyms is just the first step. It’s crucial to delve deeper into each concept to truly get a handle on trading. For instance, knowing what constitutes a “breakout” or a “head and shoulders pattern” can provide insights into market trends and potential reversal points.

If you are ready to get into trading, subscribe to our weekly newsletter here!