Trading in the stock market can be both exhilarating and daunting, especially for beginners. One of the first hurdles that new traders often encounter is the Pattern Day Trader (PDT) rule. This rule can be restrictive for those with accounts under $25,000. However, there’s a silver lining: the cash account. In this article, we’ll delve into the differences between the PDT rule and cash accounts, and how traders can leverage the latter to grow their accounts. We’ll also highlight some brokers that are ideal platforms for beginners.

What is the PDT Rule?

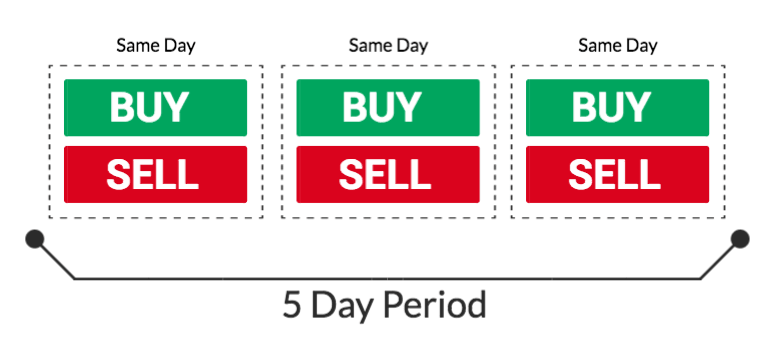

The Pattern Day Trader rule is a regulation set by the U.S. Financial Industry Regulatory Authority (FINRA). It states that if a trader makes four or more day trades (buying and selling a stock within the same trading day) in a five-business-day period, they are considered a “pattern day trader.” Once labeled as such, the trader is required to maintain a minimum account balance of $25,000. If the account falls below this threshold, the trader will not be allowed to day trade until the minimum balance is restored.

Enter the Cash Account

For those who don’t have $25,000 to start with or don’t want to risk that amount, there’s an alternative: the cash account. Here’s how it can be beneficial:

- No PDT Restrictions: With a cash account, traders are not subject to the PDT rule. This means they can make as many day trades as they want, as long as they have the funds to cover the trades.

- Trade with What You Have: Traders can only trade with the settled funds in a cash account. This can be a blessing in disguise as it naturally limits over-trading and encourages discipline.

- Learn and Grow: Starting with a smaller amount can be less intimidating for beginners. It allows them to learn the ropes, make mistakes, and grow their account organically.

Brokers to Consider

If you’re considering starting with a cash account, here are two reputable brokers that are beginner-friendly:

- TD Ameritrade (TDA): Known for its user-friendly platform and extensive educational resources, TDA is a great choice for those starting their trading journey. Link to TDA

- Interactive Brokers: This platform offers advanced trading tools and a wide range of securities. It’s suitable for both beginners and experienced traders. Link to Interactive Brokers

Futures Trading: No PDT Restrictions in Sight

For traders who find the PDT rule restrictive, there’s another avenue to explore: futures trading. Futures are financial contracts obligating the buyer to purchase, or the seller to sell, a specific asset at a predetermined future date and price. Here’s why futures trading can be an attractive option:

- No PDT Rule: One of the most significant advantages of trading futures is that they are not subject to the PDT rule. This means traders can enter and exit positions as frequently as they wish without the need for a $25,000 account balance.

- Leverage: Futures contracts allow traders to control a larger position with a smaller amount of capital. This leverage can amplify gains, but it’s essential to remember it can also magnify losses.

- Diverse Markets: Futures markets offer a wide range of products, from commodities like oil and gold to financial instruments like interest rates and stock indices. This diversity allows traders to diversify their strategies and hedge against risks.

- Nearly 24-Hour Trading: Many futures markets operate nearly 24 hours a day, providing flexibility for traders to act on global news and events as they happen.

- Regulated Environment: Futures are traded on regulated exchanges, ensuring transparency and fairness in trading.

For those looking to bypass the PDT rule and dive into a dynamic trading environment, futures might be the answer. However, it’s crucial to understand the risks associated with futures trading and to educate oneself thoroughly before diving in.

Conclusion

While the PDT rule can be a barrier for some, it doesn’t mean that those with less than $25,000 can’t participate in day trading. By utilizing a cash account, traders can start small, learn the intricacies of the market, and grow their portfolio over time. Whether you choose TD Ameritrade, Interactive Brokers, or another platform, the key is to start with a solid foundation, stay disciplined, and continuously educate yourself. Happy trading!

If you found this article or helpful, be sure to subscribe to our weekly newsletter.