In the dynamic world of trading, strategies come and go, but some stand the test of time due to their efficacy and adaptability. One such strategy is the “break and retest” method. This approach has gained traction among traders for its simplicity and effectiveness. In this guide, we’ll delve deep into the “break and retest” trading strategy, shedding light on its nuances and how traders can leverage it for optimal results.

What is the “Break and Retest” Strategy?

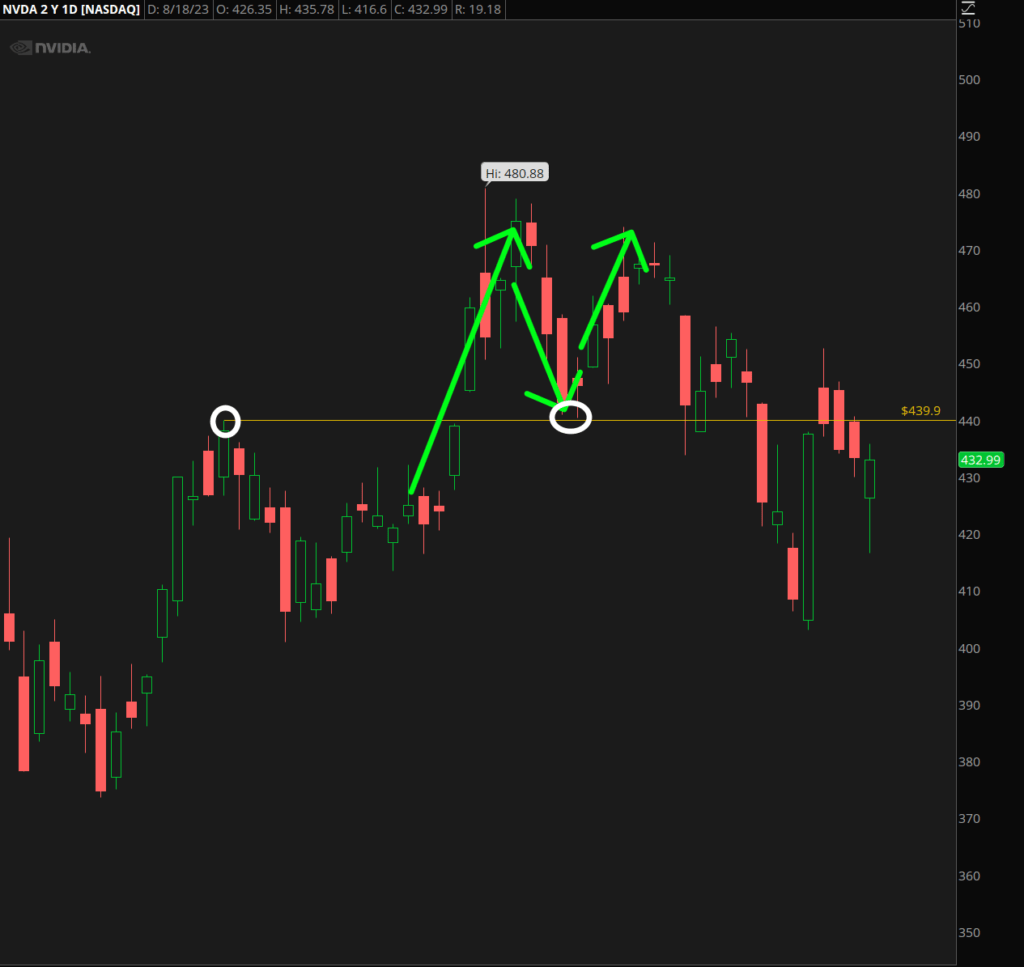

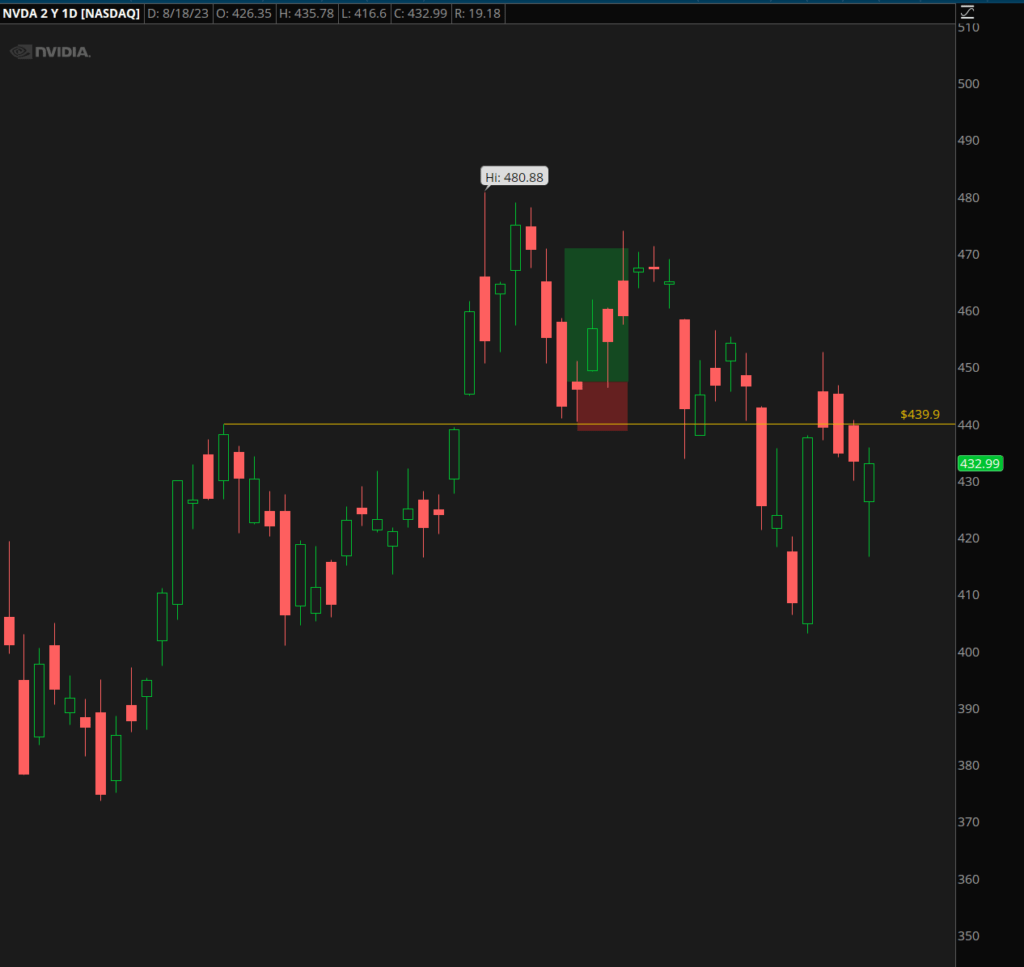

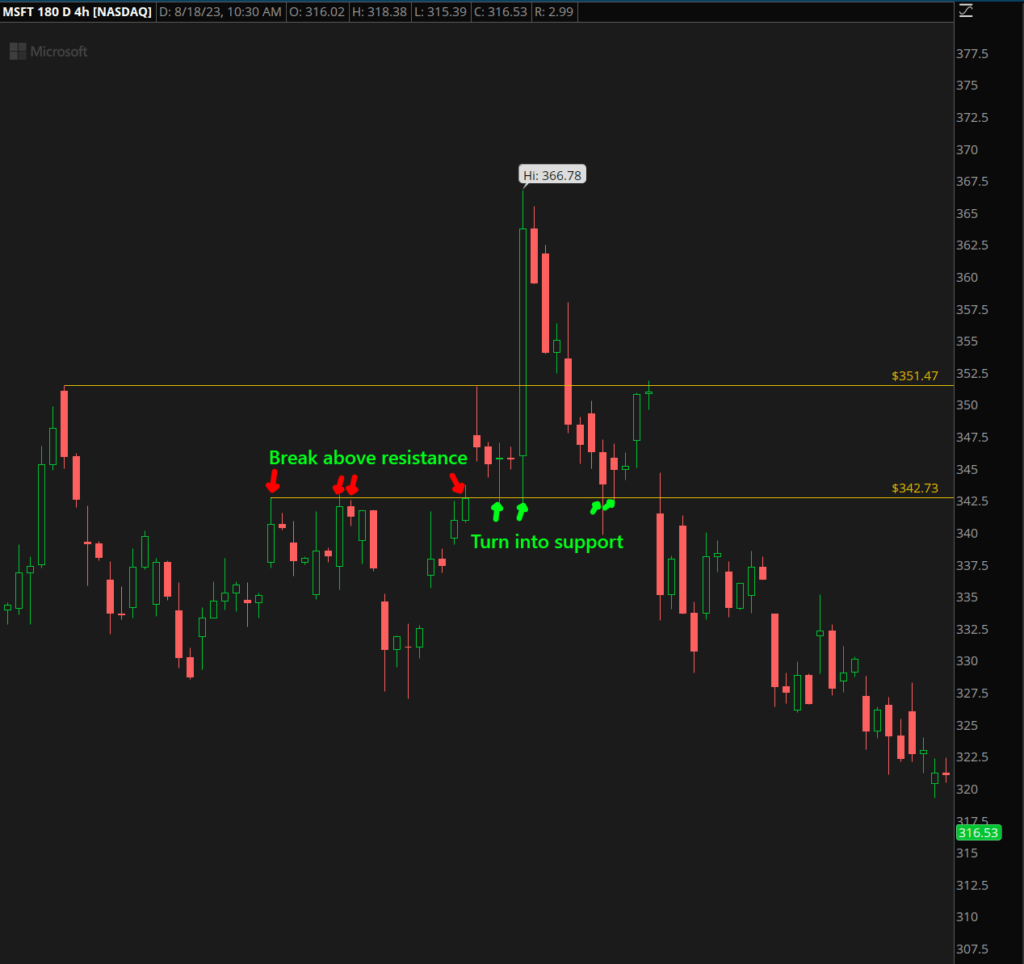

At its core, the “break and retest” strategy revolves around the concept of support and resistance levels in trading charts. When the price of an asset breaks through a significant level (either support or resistance) and then returns to test that level, it’s referred to as a “break and retest”. This retest can confirm the new role of the level – a former support may become resistance and vice versa.

If you are a member of Discord or follow us on YouTube, you commonly hear us refer to this as a “BRB” or a Break Retest Bounce/Breakdown.

Why is it Effective?

Clear Entry and Exit Points: One of the primary reasons traders favor the “break and retest” method is because it offers clear entry and exit points. Once a level is broken and then retested, traders have a clearer picture of the market’s direction.

Reduced Risk: With defined entry and exit points, traders can set stop losses effectively, minimizing potential losses.

Versatility: This strategy is not confined to a specific time frame or market. Whether you’re a day trader or prefer longer time frames, the “break and retest” can be adapted accordingly.

How to Implement the “Break and Retest” Strategy

Identify Key Levels: Begin by marking significant support and resistance levels on your chart. These levels are typically where the price has touched multiple times but hasn’t broken through.

Wait for the Break: Once a level is broken, don’t jump in immediately. Wait for the price to come back and retest the level.

Confirmation: Look for confirmation signals during the retest. This could be in the form of candlestick patterns, volume, or other technical indicators.

Entry and Exit: Once confirmed, enter the trade. Set your stop loss just beyond the retested level and aim for a target that offers a favorable risk-reward ratio.

Conclusion

The “break and retest” trading strategy is a powerful tool in a trader’s arsenal. Its simplicity, combined with clear entry and exit points, makes it a favorite among both novice and seasoned traders. As with any strategy, it’s essential to practice and backtest before implementing it in live trading. Always remember, while strategies can guide, it’s the trader’s discipline and risk management that ultimately lead to success.

If you found any value from this, be sure to check out our weekly newsletter where we go over levels and stocks to watch.

Also, if you want to go more into depth about finding key levels or levels for the break and retest. Check our the video below!