Options flow is an essential tool for traders looking to gain a competitive edge. It offers a deep dive into the world of options trading, revealing information about significant trades and potential market movements. Let’s explore how using options flow can benefit your trading strategy, understand its various terms, and address some of its cons.

What is Options Flow?

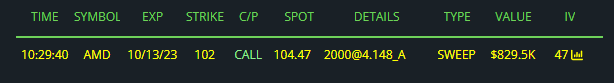

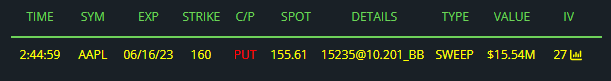

Options flow refers to the analysis of volume and direction of options trades in the market. It provides insight into where the ‘big money’ is positioning itself, potentially signaling upcoming market moves.

Interpreting Options Flow Terms

- Above Ask: When an options trade is executed above the ask price, it typically indicates a bullish sentiment. Traders are willing to pay a premium, suggesting strong demand for that particular option.

- Below Bid: On the surface, when a trade is executed below the bid price, it implies bearish sentiment, as it often means the trader wanted to get out of the position quickly. However, it’s essential to consider the other side of the coin. If traders are selling puts (which is a bullish position), it can mean they believe the underlying asset will stay above the strike price, or they’re comfortable owning it at a lower cost basis. This duality can sometimes add confusion when interpreting options flow because the action of selling puts (a bullish move) can get mixed up with the initial bearish implication of trading below the bid.

Benefits of Using Options Flow in Your Trading Strategy

- Anticipating Market Moves: By analyzing where the big players are positioning themselves, you can potentially anticipate future market movements.

- Risk Management: Options flow can help you understand the potential risks and volatility in the market, enabling you to adjust your positions accordingly.

- Enhanced Decision Making: Instead of trading based on emotion or news, options flow provides an objective data-driven approach, giving you more confidence in your decisions.

Potential Drawbacks of Relying on Options Flow

- Misinterpretation: Not every large option trade indicates a genuine market sentiment. Hedge positions or other strategic plays might mislead a trader who solely relies on options flow.

- Lagging Indicator: By the time a significant options flow is detected, the big move might have already taken place, causing traders to possibly enter at a suboptimal point.

- Requires Expertise: Properly interpreting options flow requires a strong understanding of options trading, potentially sidelining novice traders.

Conclusion

While options flow offers valuable insights into market sentiment and potential movements, traders should approach it as one tool among many. Combining options flow data with fundamental and technical analysis can lead to a more holistic and effective trading strategy.

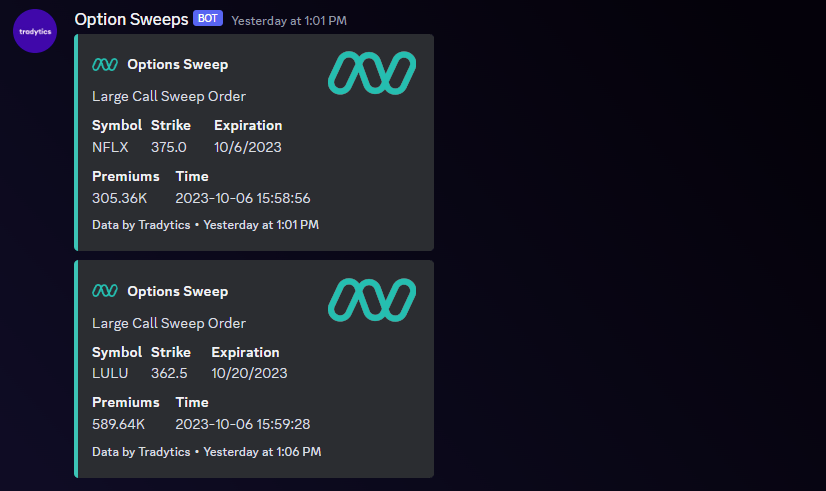

The Tradytics Bot Addition to Discord

For those looking to get real-time options flow data in our server, we’ve recently added the Tradytics bot to our Discord channel. This bot delivers instant options flow updates, helping members to quickly identify significant market activities. Using the Tradytics bot in conjunction with the knowledge from this post can enhance your trading strategy and give you a competitive edge in the market.