Introduction

If you find yourself flipping through countless charts every day to find that perfect play, only to reach the end of the day with a sense of frustration over missed opportunities, this guide is for you. Trading success doesn’t come overnight, but through continuous adherence to a set of key concepts. In my journey to trading success, I’ve identified three fundamental concepts that can help ensure consistent growth over time.

The Game-Changing Trio

These three components, concentration, risk-reward understanding, and persistence, have drastically transformed my trading success. Each of them builds upon the other, ultimately leading to a well-synchronized strategy that consistently yields returns in both short and long terms.

Concentration: Mastering Few Stocks

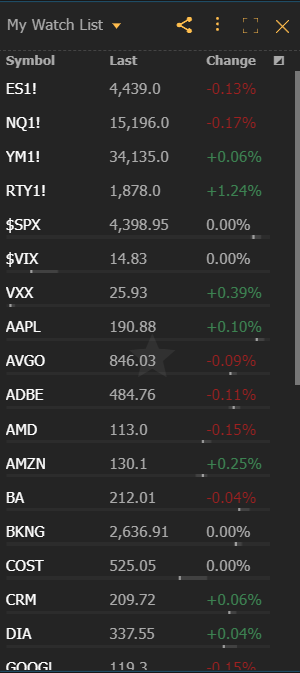

The first rule of thumb is focusing on trading 3 to 4 stocks. Instead of spreading yourself thin by trying to monitor countless stocks, narrow your focus. Choose an index like Spy and slower movers like Google, along with industry leaders like Apple. And if you prefer a little thrill, throw in a fast mover like Tesla.

By concentrating on these few stocks, you familiarize yourself with their unique movements, which is invaluable when it comes to making informed trading decisions.

Understanding Risk-Reward: Minimizing Losses, Maximizing Gains

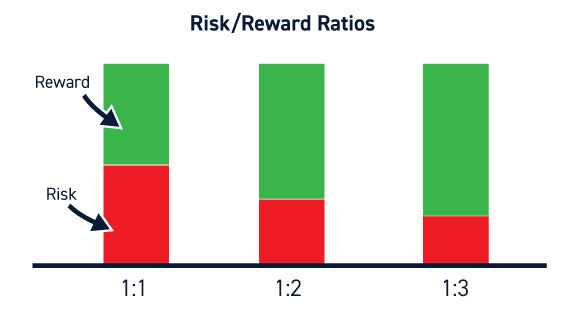

The second key concept is understanding risk-reward dynamics. The point here is to identify which trades you should and should not take. For instance, in a long-term uptrend, long trades yield a higher risk-reward ratio than short trades. This understanding could mean the difference between trading success and recurrent losses.

Moreover, the understanding of risk-reward directly influences your trading decisions. For instance, when trading options, knowing that Apple, being a safer name, will not have drastic movements allows you to make risk-mitigated decisions.

Persistence: Staying the Course

In trading, persistence is your best friend. When you’re trading a select number of stocks, there will be moments of frustration, especially when you see other stocks skyrocketing. But this is where persistence comes into play.

Remember, everyone else’s progress shouldn’t deter you from your chosen path. Your growth is what matters most. The idea is to master the few stocks you’ve chosen, then slowly expand your portfolio over time.

Combining Concentration, Risk-Reward, and Persistence

When you start focusing on a few stocks and understand their risk-reward dynamics, your trading strategy starts to crystallize. And by persisting with your strategy, you create an environment where successful trades can happen.

Trading success lies not in making a large number of trades but in making a few great ones. By winning on 3 out of 5 great trades, you can ensure your profits outpace your losses, leading to consistent trading success.

Conclusion

Understanding and applying the principles of concentration, risk-reward, and persistence can greatly enhance your trading performance. By focusing on a few stocks, understanding their risk-reward dynamics, and remaining steadfast in your strategy, you set yourself on a path of consistent trading success. Remember, aim small, miss small, and your winners will greatly outweigh your losses.

Be sure to check out this video if you want to go more into depth about everything covered in this article! And if you learned anything be sure to sign up for our weekly newsletter and share this with friends! Best of luck in your trading!