Introduction

Have you ever been lured into a trade based on the assumption that you’ve spotted a particular pattern – say a double top? Many traders make this common error, stepping into trades based on what they anticipate will happen, rather than reacting to the market’s current reality. In this post, we will illustrate exactly how this approach leads to losses and what you should do instead.

The Trap of Anticipation

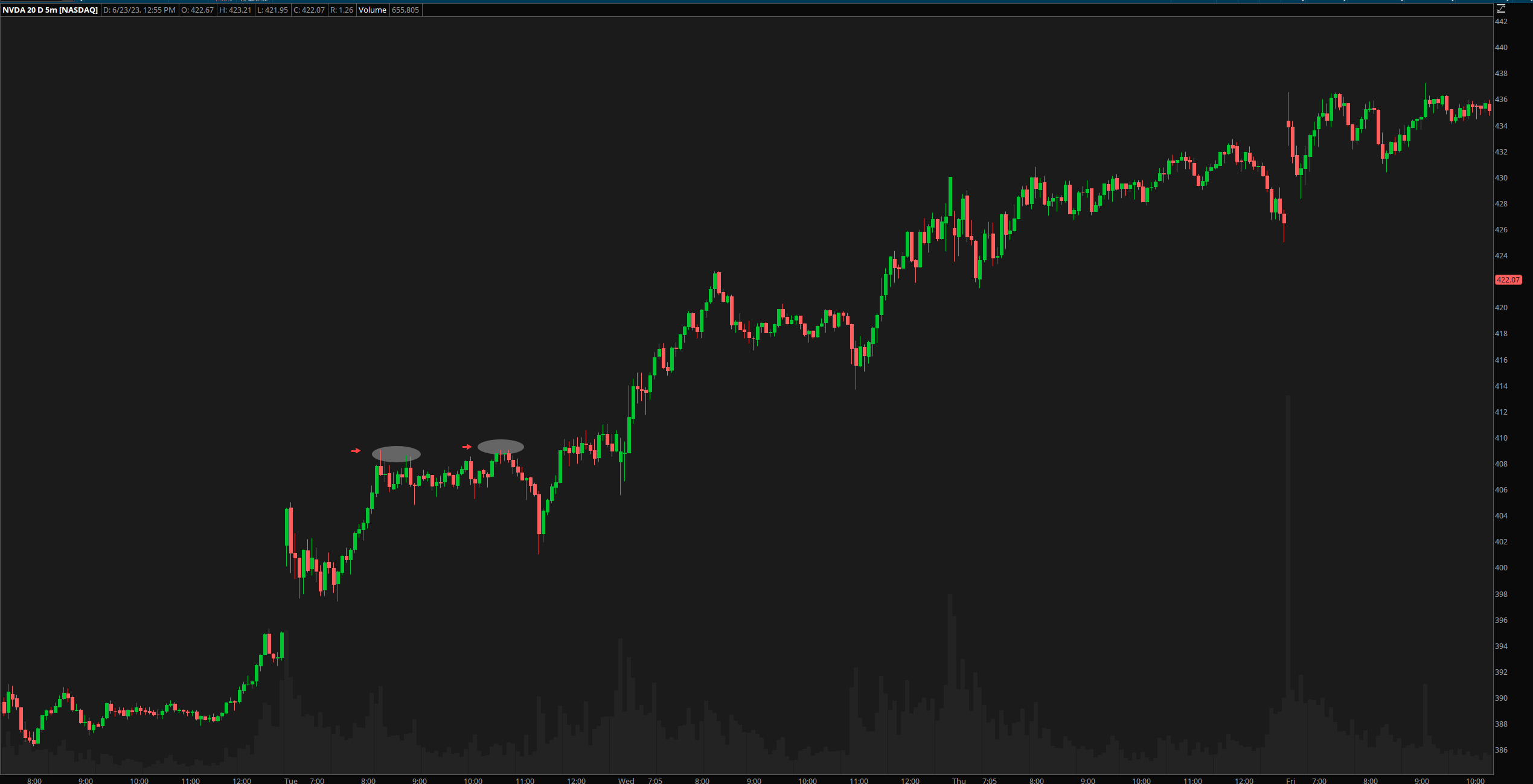

When you start day trading, you might notice a stock taking an initial plunge. At this moment, the instinct of many is to assume that this is a telltale sign of a double top pattern. But as we’ll see, this kind of anticipation can lead you down a path of losses.

Recognizing Higher Lows

If you keep an eye on the trend following that initial drop, you’ll notice the stock begins to make higher lows. Contrary to your initial assumption, this isn’t confirming your entry point for a short position, it’s leading you into a potential trap.

Understanding Breakouts

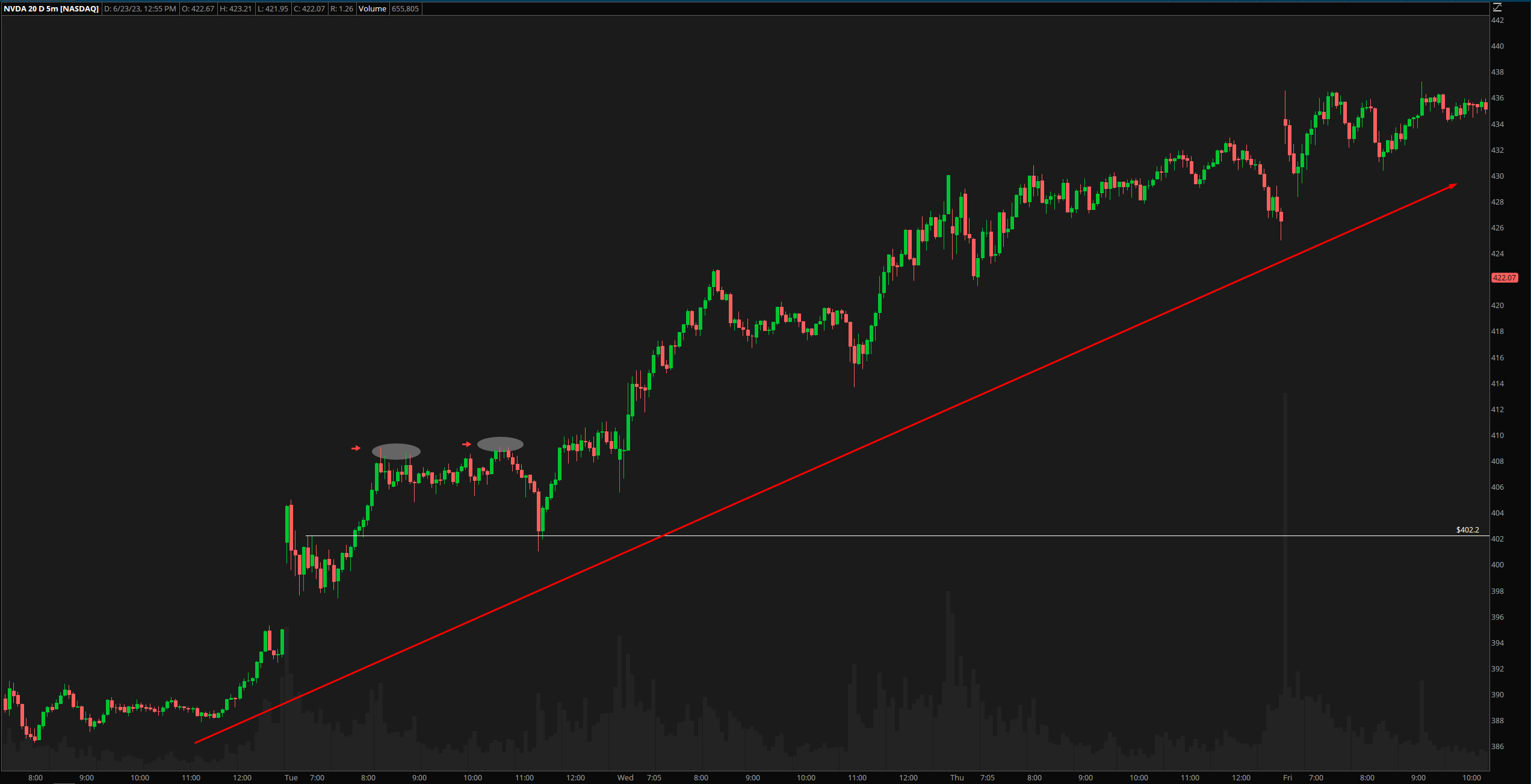

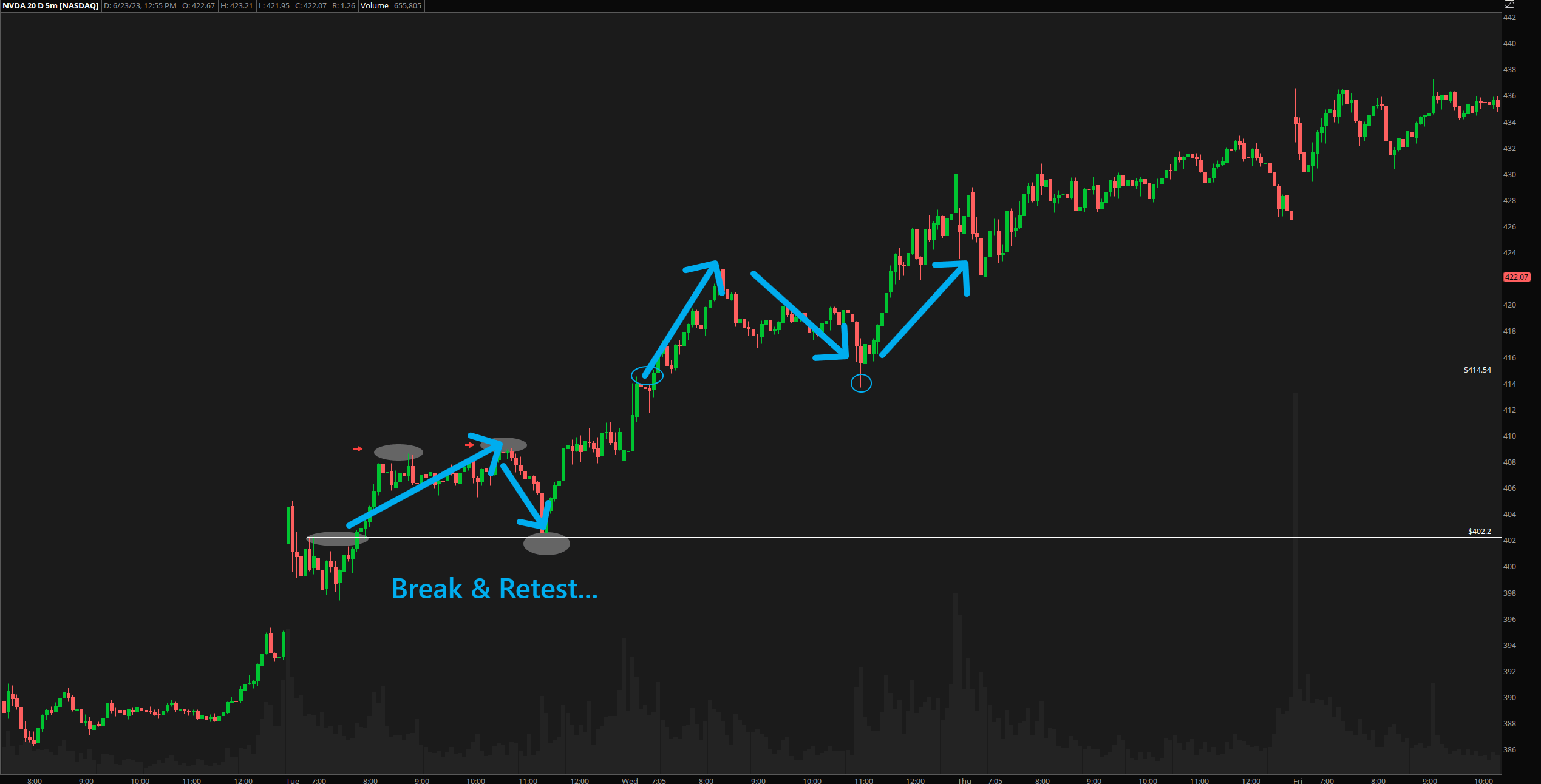

Instead of providing a signal for a short position, the trend we’re observing could very well be a confirmation to go long. By zooming in on the chart, you can observe that the price breaks above, retests, and then continues its upward trajectory.

This is a classic breakout pattern, and it’s signaling a bullish trend rather than a bearish one. Your anticipation of a double top would have resulted in a loss if you’d gone short on this stock.

The Takeaway: React, Don’t Anticipate

The critical takeaway here is to stop trying to anticipate the market and start reacting to what the market is currently presenting. This doesn’t mean you have to ignore potential patterns or signals, but it’s essential to confirm these signals before you act on them.

By understanding and reacting to actual market trends instead of anticipating them, you can significantly improve your chances of profitable trades. After all, the market doesn’t care about our predictions – it moves according to its own rules.

Conclusion

Day trading can be a profitable venture, but it requires the right approach and a clear understanding of the market’s patterns. Avoid falling into the trap of anticipation, and instead focus on reacting to confirmed trends and patterns. Stay tuned for more insights into the world of day trading, as we continue to explore strategies and tips to help you navigate the complex yet rewarding world of financial markets.

Also be sure to check out our weekly newsletter for options trading and general trading information!