Introduction

Have you ever wondered how professional traders gain a competitive edge in today’s fast-paced and volatile markets? One of the secrets to their success lies in their ability to analyze and understand Time & Sales and Level 2 data. By mastering these essential tools, you can make more informed trading decisions, increase your probability of success, and ultimately, achieve greater profits. In this blog post, we will explore the benefits of using Time & Sales and Level 2 data in your trading strategy and provide tips on how to effectively utilize these valuable resources.

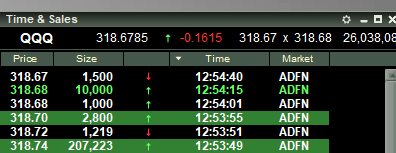

Understanding Time & Sales Data

Time & Sales data, often referred to as the tape, provides real-time information on the last executed transactions in a particular market. It includes details such as the time of the trade, the price, and the number of shares or contracts traded. By examining this data, you can gain insights into the market’s trading activity and trends.

Identifying Buying and Selling Pressure

Time & Sales data allows you to gauge buying and selling pressure in the market. By observing the frequency and size of transactions, you can determine whether there is more demand or supply, which could indicate potential price movements in the short term.

Analyzing Trade Volume and Liquidity

The volume of trades occurring at different price levels can provide valuable information about the liquidity of an asset. High liquidity often leads to tighter bid-ask spreads, making it easier for you to enter and exit positions at favorable prices.

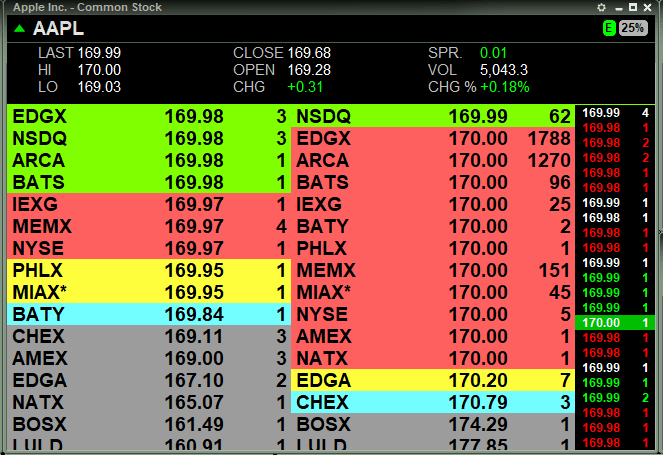

Unlocking the Power of Level 2 Data

Level 2 data, also known as the order book, displays the bid and ask prices for a particular security along with the corresponding sizes of the orders. This data allows you to observe the depth of the market and provides critical insights into the balance of supply and demand.

Identifying Key Support and Resistance Levels

By examining Level 2 data, you can identify key support and resistance levels, which are crucial for determining potential entry and exit points in your trades. These levels can help you to set stop-loss and take-profit orders strategically, thereby minimizing your risk while maximizing your gains.

Recognizing Order Imbalances and Potential Breakouts

An imbalance in buy and sell orders can signal potential breakouts or reversals in the market. For example, a large buy order that surpasses the available sell orders at a specific price level could drive prices higher. Being able to spot these imbalances can give you a head-start in capturing significant price movements.

Combining Time & Sales and Level 2 Data for Enhanced Trading Decisions

By integrating Time & Sales and Level 2 data into your trading strategy, you can gain a comprehensive understanding of market dynamics and make more informed decisions.

Confirming Trade Signals

Use Time & Sales and Level 2 data to confirm trade signals generated by your technical or fundamental analysis. This additional layer of validation can increase your confidence in your trades and reduce the likelihood of false signals.

Fine-tuning Your Execution

Incorporating these data sources can help you fine-tune your trade execution by identifying the best prices and times to enter or exit positions. This can lead to improved trade execution and ultimately, better overall trading performance.

Conclusion

Time & Sales and Level 2 data are indispensable tools for any serious trader. By understanding and leveraging these data sources, you can enhance your trading strategy, increase your probability of success, and ultimately, achieve greater profits. Start incorporating Time & Sales and Level 2 data

If you found this article helpful or learned anything. Be sure to subscribe to our weekly newsletter and share with your friends!