Introduction

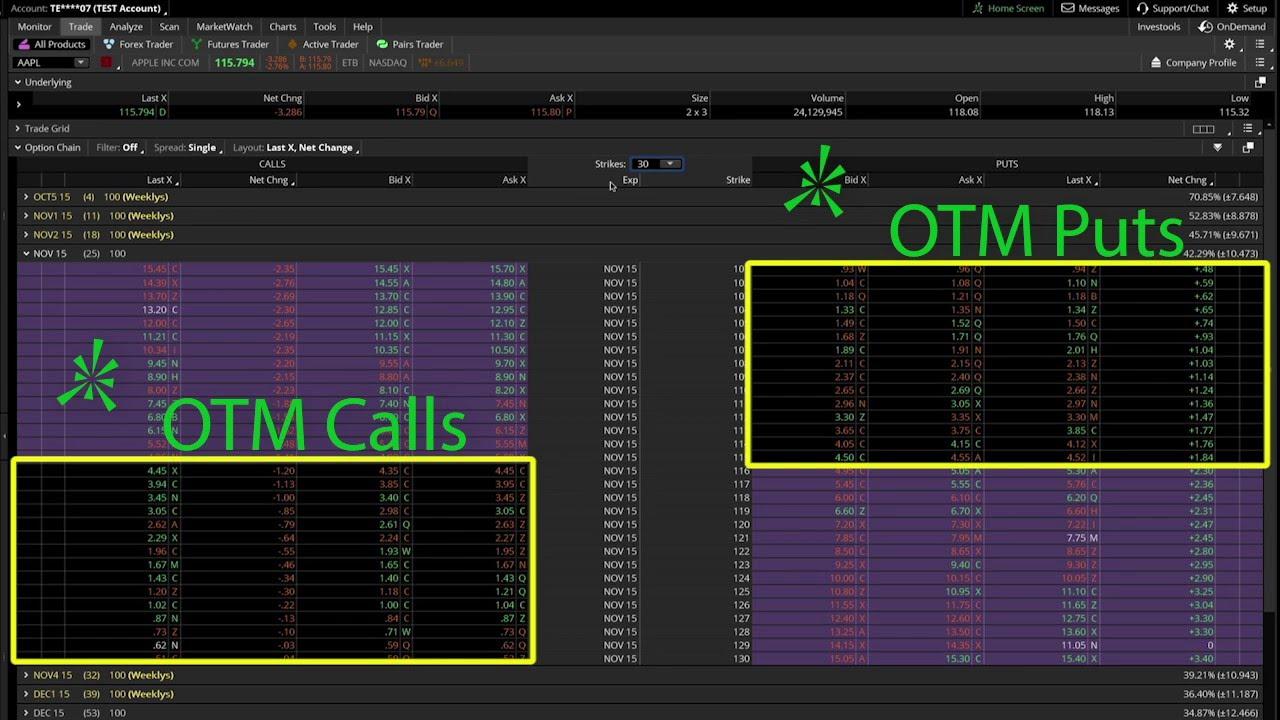

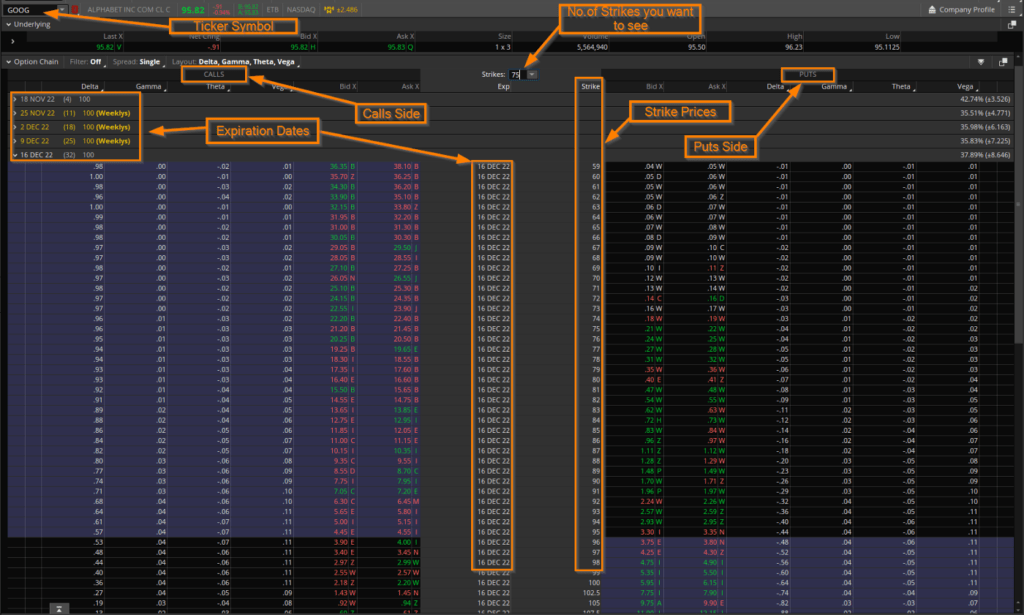

Picking the right strike price when trading options is a crucial part of developing a successful trade plan. However, it can be challenging to choose the perfect strike as it depends on various factors, including your trade plan, the type of trade you’re executing, and the day you’re trading.

Consider Your Trade Plan

If you’re scalping, it’s advisable to avoid far out of the money contracts. Instead, you should consider selecting a strike that’s a bit closer to the underlying trading price. For instance, if you’re trading Tesla around $200, you should consider the 205c/195p strike, which has more potential for volatility.

At-The-Money Strikes for Scalping

However, if you have a smaller account, you might want to stick to trading less expensive stocks or equities such as Apple or SPY and opt for at the money options instead of going too far out of the money.

Select Strikes Further Out of the Money for Day Trading

If you’re planning to day trade a stock and hold it for the entire trading day, it makes sense to select a strike that’s a bit further out of the money. This is because you have more time on the contract, which means your position will require less buying power, and you’re hopefully going for a bigger percentage gain rather than scalping for smaller gains.

Swing Trading Opportunities

If your plan is to swing a position, and you see a great opportunity that will last for several months, it makes sense to go a bit further at the money to let the position work for you. The contracts may be a bit more expensive, but this can potentially yield bigger gains as the contract goes up in value over time.

Using LEAPs for Long-Term Trading

Lastly, you can also consider using a LEAP (Long-term Equity Anticipation Security) like Nancy Pelosi and her husband. LEAPs are a type of option contract that expires in more than one year, and they allow you to hold a stock you like for an extended period. By going deep in the money, you can save on buying power and potentially see more significant gains as the contract moves like a hundred shares.

It’s also worth considering using spreads of these positions, such as debit spreads, credit spreads, or calendar spreads, which can offer more significant opportunities for profit.

Summary

In summary, when picking the right strike for your options trade, it’s essential to consider your trade plan, the type of trade you’re executing, and the day you’re trading. By taking these factors into account, you can make informed decisions that increase your chances of making a profitable trade.

If you gained anything from this article, please consider sharing with friends! Be sure to check out our newsletter for weekly market analysis!