Introduction

Bull and bear flags are classic technical analysis tools used by traders to identify potential profit-making opportunities in a trending market. In this blog post, we’ll delve deeper into the bull and bear flag patterns and how to trade them.

What Are Bull and Bear Flag Patterns?

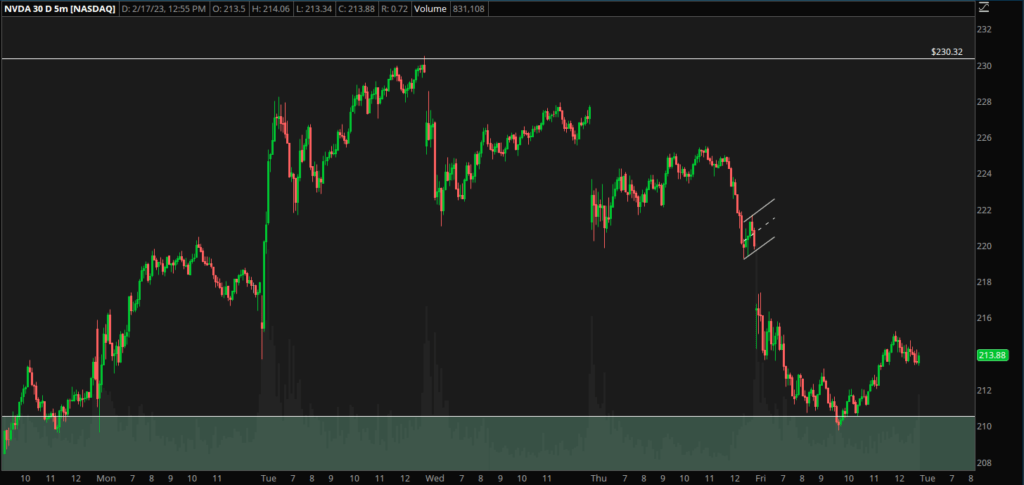

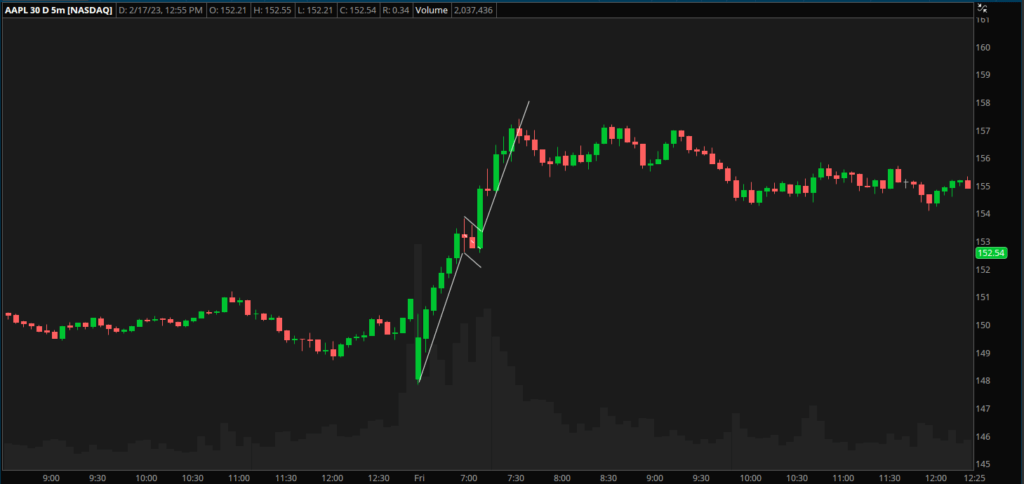

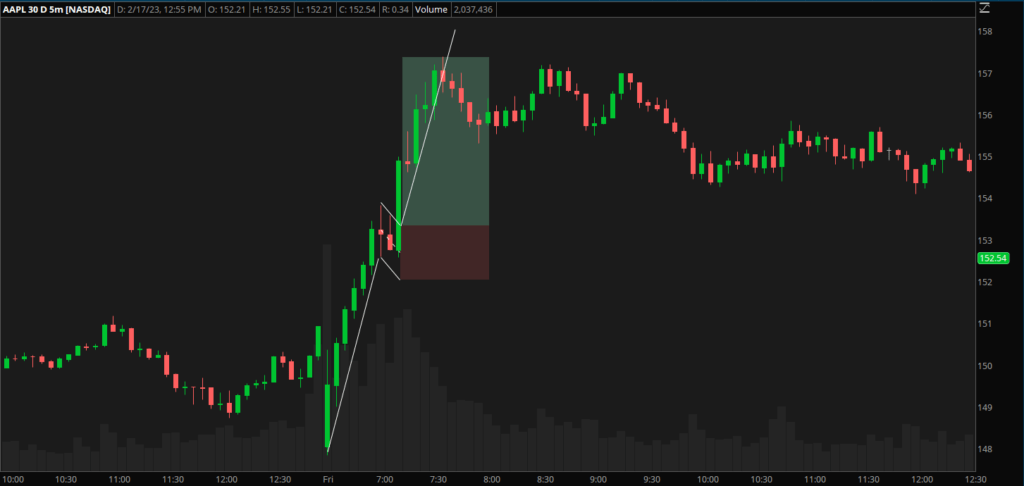

The bull flag pattern is a bullish continuation pattern that appears during a market trend, while the bear flag pattern is a bearish continuation pattern that appears during a downtrend. To trade these patterns successfully, it’s crucial to identify them in the market and wait for the consolidation period to form, followed by a sharp price breakout.

How To Trade the Bull and Bear Flag Pattern

To trade the bull and bear flag patterns, you should set your take profit level by measuring the height of the flagpole and adding it to the breakout level for a bull flag and subtracting it from the breakout level for a bear flag. Setting a stop loss just below the consolidation period for a bull flag and just above the consolidation period for a bear flag will help you limit your potential losses.

The Importance of Risk Management

It’s important to keep in mind that trading the bull and bear flag patterns carry risks, and it’s essential to have a solid risk management plan in place. Back testing your strategies before applying them in a live market can help you identify potential challenges and overcome them effectively.

Conclusion

In conclusion, trading with bull and bear flags can be profitable, but requires a deep understanding of technical analysis and market trends. By following the right steps and incorporating risk management strategies, you can master the art of trading with bull and bear flags and enhance your trading performance in the long run.

If you learned anything from this post, considering sharing it your friends! If you want more in depth analysis on the market. Considering subscribing to our newsletter for weekly market analysis!